The Vietnamese stock market has been sluggish for a long time, while the US stock market and several individual Finnish stocks have performed well. However, all the elements for a brisk stock market performance in Vietnam exist; here are the potential triggers and key reasons:

- The US-China trade war has calmed down

- The dollar’s strengthening trend is over

- Vietnamese listed companies´ earnings have kept rising, but Vietnamese stock market performance has stalled

- The Vietnamese banking sector has an excellent outlook for earnings growth and many stocks in the sector have drifted to way too cheap levels

- New Special Focus ETFs launching their investment activities.

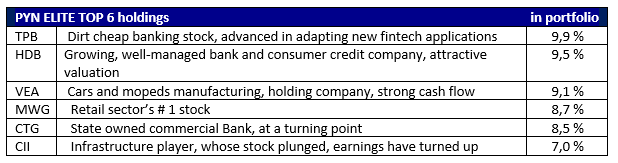

The core companies in our portfolio have released results that should support their stock performance. TPB’s profit increased 71%. The result was excellent already in 2018. In 2019, all previous actions taken by TPB paved the way for continued excellent earnings growth.

MWG posted a very good annual result, a 33% increase in earnings. We bought MWG shares a bit more ahead of result release last week as FOL-free shares were available for pick up through the stock market at low prices. MWG’s share in portfolio is now at 8.7% and if we wanted we could sell blocks off-market at a good price, but for now MWG is a hold after we realized large position of it late fall.

With the cash from MWG trade, we have built a significant new position in CTG bank. CTG is one of the major state-owned commercial banks whose share price performance has been substantially lagging behind peers BID and VCB due to the longer duration of the CTG´s balance sheet clean-up after the past Vietnamese banking sector crises.

During 2019, the market was aware of a major shareholder wanted to substantially reduce its holding in CTG, but desired asking prices were too high. The share fell during the year and at the same time its reference banks BID´s and VCB´s shares rose substantially. The seller got frustrated and ended up making block trades at rather attractive levels – we were one of two big buyers. In addition to these block trades, we also increased our CTG position directly from the market in December with favorable prices. CTG’s result for 2019 increased 75% due to easing of the provisioning pressures on the old loan book.

Of our key holdings, VEA posted a 4% increase in earnings, which can be considered good, as it has also cleaned up the old receivables of the holding company. All year 2019, we were on the buy-side of VEA, and we see the next five years as very positive for the growth of its co-owned car and moped plants. VEA’s dividend is expected to increase in the next few years, although dividend yield is already 9%.

HDB bank and infrastructure construction company CII will only announce their results after the Vietnam TET holidays, but both are to show good earnings improvement for 2019.

The Vietnamese stock exchange is closed during TET holidays 23-29 January.