The US stock markets crashed 57% from their peak levels during the 2008–2009 financial crisis. The 1929 stock market crash was a similar magnitude of 50 %, but it was followed by a banking crisis that lasted around three years, adding up the total market crash to –90%. In other words, 90 dollars was lost on every 100 dollars Admittedly, stock market crashes are an integral part of the investment world and serve to even out long-term stock returns within a realistic frame. The 1929 crash was justified, but the events from 1930 to 1932 could have been avoided through measures by the government and the Fed. Understanding of the necessary measures has only increased later, however.

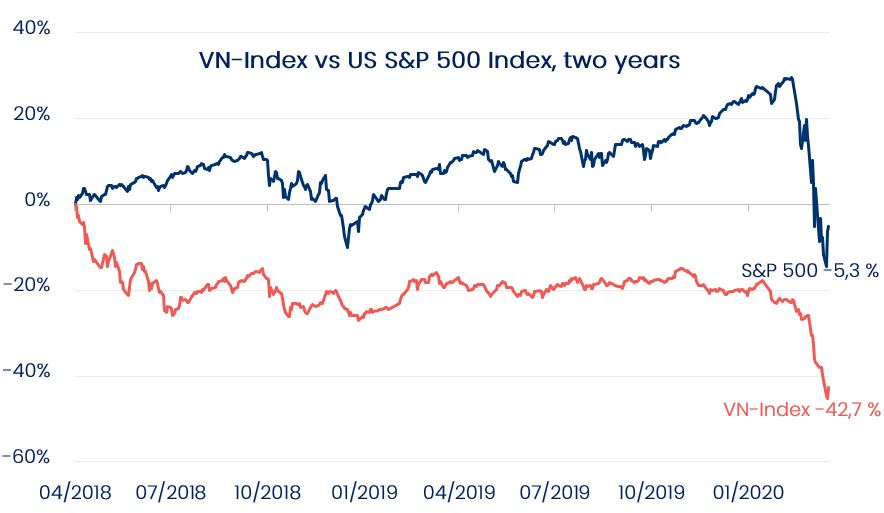

The stock market crash, what we are witnessing right now is a consequence from the good returns and outperformance of the last few years which is now ending very aggressively due to the covid-19 virus. Albeit, the USA stock market has so far sunk just 27% from its peak level in February. If we look into Vietnam, the VN Index peaked in April 2018 and has already come down 43% since then. During the period, nearly a two-year span, the US S&P stock market index has only declined 5.3%.

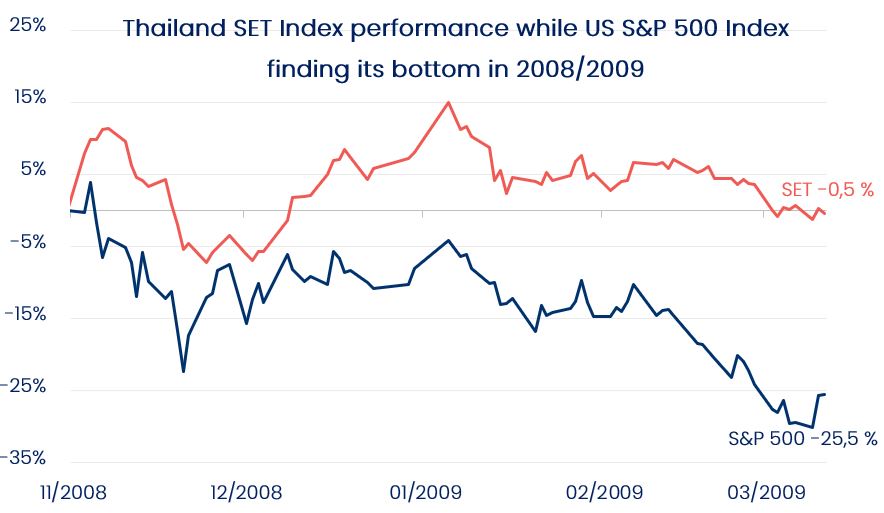

Our fund was invested in the Thai market in 2008/2009 and the total decline in the country’s SET Index during that time was 58%. In the end stage of the crisis, the US stock markets continued to bottom out, taking a further 30% drop over the last five months. At the same time, the Thai SET Index was already flat, in other words it did not follow the declining US stock prices, despite the later outcome of intensive collapse in the export markets.

Vietnamese stocks are already dirt cheap, due to the said total decline of 43% over two years. US stocks still have room to decline, even though the federal government and the Fed are currently taking very rapid and extensive measures to ease up the market pressures. Asia will be the first one to recover from this recession and the Asian domestic consumer markets are already a major force that will boost economic growth in the next few years. I cannot estimate if Vietnam’s VN Index will end up an additional 10% to 15% lower than the current 690 level, but this market offers now favorable conditions to make stock moves and finetune allocations.

We recently reduced our EUR/USD forex hedge to just 50%. This measure serves to prepare us for increased nervousness in the USD-based debt markets, but we are ready to modify further our hedging policy as the situation progresses. The measure also decreases the amount of cash needed in the portfolio for hedging contracts and thus reduces the need to sell stocks at the current index levels in order to maintain cash collaterals. This way it also makes it possible to increase the share of assets invested in stocks.

I have personally accumulated some cash and intend to subscribe additional Pyn Elite units on the March 31 subscription date.