During the past few years, investors across the world have achieved excellent returns in the US market and in growth stocks in particular. Many investors can congratulate themselves for what they have accomplished. Nevertheless, it looks like we are transitioning to a period in which “easy” returns from the stock markets are a thing of the past. No investment recommendation should be taken for granted. Investors should think about how they have positioned their portfolios for different market scenarios.

For a long time now, equities have been the only sensible and justifiable asset class to hold, but even this needs to be questioned in the next few years. There will surely be volatility in the markets. There may be further upward movement after the recent sell-off, but the current ten-year period (2021–2030) may turn into fairly modest, especially for US growth stocks, when we once are able to look back at the average annual returns.

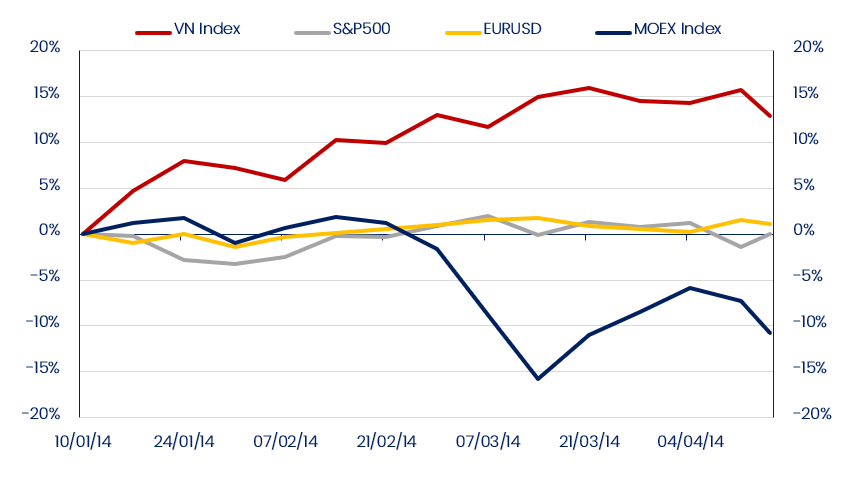

From the Finnish perspective, the possibility of war is also a concern in the short term. In our assumptions, we have arrived at a scenario in which Russia will invade eastern Ukraine in early February. The potential market impacts of such a war are not evident on the Vietnamese stock market due to the stock exchange being closed for a week for the Tet celebration to mark the Lunar New Year.

In our view, the most likely scenario is that Russia will capture the eastern parts of Ukraine in a brief offensive without much bloodshed, but the city of Mariupol will still remain under Ukrainian control. The economic impacts of a potential war would mainly consist of economic sanctions against Russia, which would weaken the Russian currency and stock market.

Of the wars that Russia has been involved in, the annexation of Crimea is probably the most obvious comparison. If the Russian invasion were to begin soon and if the conflict were to be short-lived, uncertainty in the investment markets could even decrease. We have had to evaluate the situation in Ukraine and its consequences especially due to our EUR/USD hedging contracts. We have decided to keep our currency hedging unchanged for the time being.

The annexation of Crimea and the markets in 2014

MOEX: Russian stock market. Source: Bloomberg

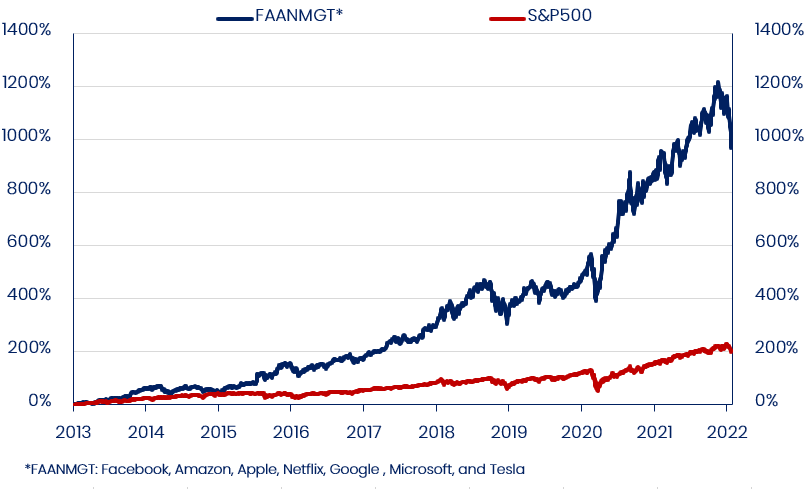

Nasdaq reached its peak in November

It is possible that the US Nasdaq index, which has its emphasis on growth stocks, reached its peak value in November 2021 and is now in decline, with volatility expected along the way. Rather than guess when the index could reach its highest point, it is more relevant to look at what happened in the markets before November.

Net money flows into US growth stocks have been the playbook for several years. With the valuation multiples of individual stocks having risen to high levels, they still provide opportunities for returns, but the likelihood of excellent further returns has decreased while downside risks have increased. The expected multiples have undoubtedly reached high levels and the unbalanced allocation of global investment flows to US growth stocks has been very significant. The weight of the US stock market compared to global equities has never been as high as it is now.

Potential interest rate hikes by the Fed will affect high-growth companies’ opportunities to successfully carry out additional funding rounds at high valuations. This may lead to companies shifting the focus of their growth strategies from rapid top line growth to positive cash flows, which may have a substantial impact in terms of tempering expectations of revenue growth. Lower growth targets would have a cascade effect on the valuation multiples of these companies’ stocks.

Investments by large concentrated on tech stocks in the US market

Source: Bloomberg

The moves of central banks to tighten market liquidity and to hike interest rates are also a warning signal for reasonably priced value stocks. The interest rate hikes will take place during a period of strong economic growth, which means that good earnings growth may still be seen, which, in turn, can elevate stocks to new all-time highs.

However, the danger is that extremely sudden drops in the value of growth stocks will also have cascade effects on the real economy, which can easily lead to an overall economic slump. Of course, in this scenario, central banks would try to stimulate the economy by cutting interest rates.

The events seen in the market in 2000–2002 provide interesting simulations to the current situation. Back then, value stocks did well after growth stocks had begun to fall. Around the same time, the Fed hiked its reference rates. However, there are also many differences between the current situation and that of two decades ago. Even multiple interest rate hikes would not bring interest rates to a high level, which makes it possible to conclude that stock prices would not need to fall very much in relative terms.

It should also be noted that central banks tend to fail when there are rapid turns in the economic cycle, and quick events in the markets tend to drag real economies into a recession. This may lead to a situation where interest rates have not reached a high level and economies are already starting to cool down. This would bring about a situation with minimal potential for economic stimulus through interest rates. In the worst-case scenario, this could usher in a long period of weak economic growth.

The bursting of the tech bubble in 2000-2002

Source: Bloomberg

In 1999, the Fed raised interest rates three times, bringing the rate from 4.75 percent to 5.5 percent. In 2000, there were three further interest rate hikes, from 5.5 percent to 6.5 percent. Growth stocks had a delayed reaction to the interest rate hikes of 1999, with their decline only starting in March 2000.

While growth stocks tumbled, value stocks performed well in 2000 only to start sliding later due to weaker economic growth – in spite of the fact that economic stimulus measures started at the beginning of 2001.

PYN Elite and Vietnam

We are hopeful regarding the potential returns of the Vietnamese stock market in 2022 and very bullish when it comes to the performance of the Vietnamese stock market over the next five years. Our long-term index target is 2,500 points.

Vietnamese listed companies have strong balance sheets, the government accounts are financially robust, and Vietnam keeps generating trade surplus. A weak global economic situation would see the growth of Vietnamese exports slow down, but the country’s economy would be able to withstand this.

There would be shocks in the Vietnamese stock market if a downturn caused by growth stocks would turn into a general bear market and expectations of a recession. The potential sell-offs in the Vietnamese stock exchange may be strong, but we expect that they would be short-lived.

The expected earnings growth of Vietnamese listed companies for 2022 is +25 percent and the P/E for 2022 is moderate at 13.7, taking into account the good earnings growth outlook for the coming years.

Special notes:

• The new trading platform of the Vietnamese stock exchange will be deployed in spring 2022, enabling day trading and the discontinuation of the prefunding practice. This is an important milestone on Vietnam’s path to Emerging Market status.

• The P/E for the VN Index is low at 13.7, compared to 17.6 in Thailand, 20 in the United States and 16.2 in Finland. Among these countries, Vietnam has the strongest earnings growth forecast for 2022.

• The PYN Elite portfolio includes several companies that are turnaround cases after the COVID-19 pandemic, and we will keep a close eye on their earnings reviews in 2022.

• Compared to the times of tech bubble (2000) and the US subprime crisis (2008), the PYN Elite portfolio is now very different, consisting mainly of large-caps, financially stable listed companies.

• China’s Central Bank kept money markets tight in 2020–2021 and only started to loosen its policy in late 2021. It is likely that China’s Central Bank, like its Vietnamese counterpart, will take measures in 2022 to stimulate growth.

• Moderately priced value stocks still have a good earnings outlook in 2022.

Important information regarding the text and the Fund

The material presented in this text is based on PYN Fund Management’s view of markets and investment opportunities. PYN Elite Fund (non-UCITS) invests its assets in a highly allocated manner in frontier markets and in a small number of companies. This investment approach involves a larger risk of volatility compared to ordinary broadly diversified equity investments. The value of an investment may decline substantially in unfavorable market conditions or due to an individual unsuccessful investment. It is entirely possible that the estimates of economic development or a company’s business performance presented in this presentation will not be realized as presented and they involve material uncertainties.