Vietnamese bank stocks performance has shown promising signs this year, but price gains have remained moderate, ranging at level of 15% to 30%. In a period of less than three years, many bank stocks have even recorded declines of 10% to 20%. During these 3 years, however, banks have continued to achieve earnings growth, albeit at a slightly slower pace, their businesses have expanded greatly, and their equity has accumulated significantly.

In our opinion, the sector offers the potential for robust earnings growth in coming years with very reasonable risk. The current conditions are particularly enticing as Vietnam’s GDP growth rate could reach as high as 7% annually. Recently, we sold a position from PYN Elite’s bank portfolio that had outperformance by gaining over 60% in a year. We are reallocating these profits by maintaining an overweight position in banks, targeting selected picks we expect to deliver the most impressive earnings jumps in 2025.

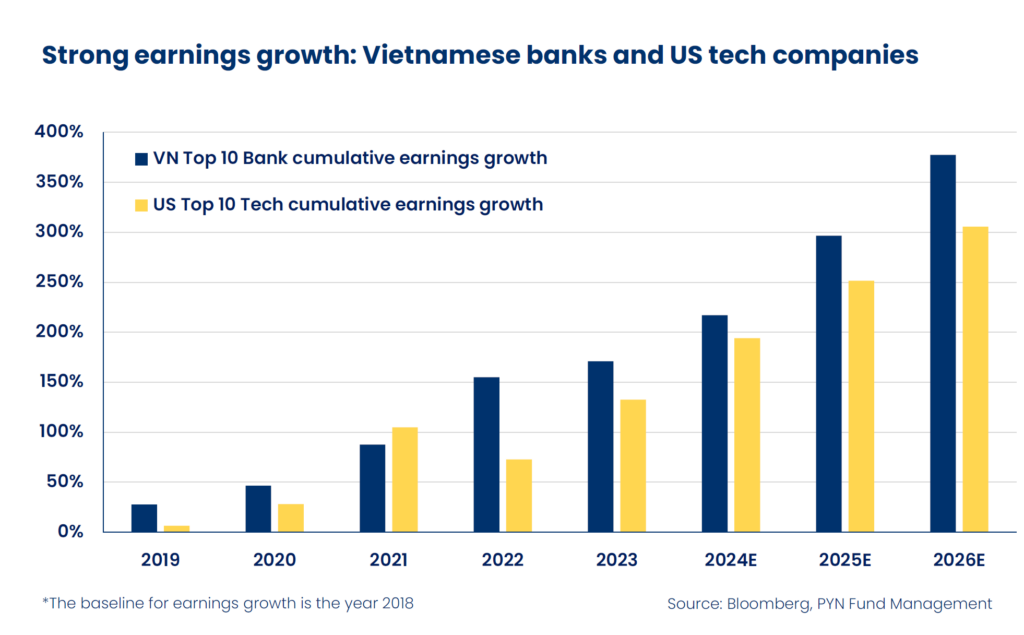

Vietnamese banks can even outperform US tech companies with their earnings growth. Despite this, the past three years have seen bank stock prices moving in the opposite direction. From a risk management perspective, now might be an excellent time to shift allocations from trendy tech stocks to the less sexy Vietnamese banks. The next PYN Elite subscription date is Friday, 29th of November.